Farm Management Deposits scheme (FMD)

As we are seeing an unprecedented levels in Beef cattle prices we recommend all Beef cattle and sheep farmers to use the Farm Management Deposit Scheme.

What is the Farm Management Deposit Scheme?

The scheme works as follows – The Farmer sells 100 head of cattle and receive the funds of $170,000. The is treated as income in the farmers tax return.

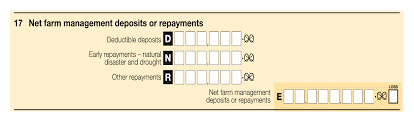

The farmer opens up an FMD account at the Bank and deposits $120,000. The $120,000 is treated as a tax deduction in the year of the deposit.

In two years’ time, when things are a bit tough – the farmers withdrawals $50,000. The withdrawal of $50,000 is treated as income in the year it is withdrawn from the FMD account.

(Note - if funds are withdrawn in 12 months there is no tax deduction)

There are 5 exceptions to the 12 month rule:

- You become bankrupt.

- You cease to carry on a primary production business for 120 days or more.

- There is severe rainfall deficiency

- You receive assistance following a natural disaster

- As an account holder, you pass away.

As primary producers are one or our niche areas of expertise, we can assist you with all areas of your farm accounting needs.

Don’t hesitate to contact us for more information.

.jpg)