Accounting for Restaurants

& Cafés

Click HERE to view or download PDF

JTU Accounting Group - providing specialised accounting advice to restaurants, cafés and the hospitality industry.

There's no doubt, establishing and running a restaurant, bar or café is challenging. Apart from the usual small business compliance issues of GST, BAS, PAYG and superannuation you have to contend with heavy regulations around liquor licensing laws, food handling regulations and various council permits. As you know, customers can also be hard to please!

You probably have to deal with irregular trading hours, erratic and seasonal trade, casual employees and of course, occupational health and

safety issues. You need to manage a combination of dry and wet goods plus your commercial tenancy lease can be complex. Given occupancy

costs are usually one of your largest expenses in a restaurant or cafe (together with staff wages) we can help you negotiate the terms of

your retail lease and even liaise with your solicitor where required.

Running a hospitality business can be hard work, particularly if you're on your feet all day or night. Having an accountant who understands your industry can provide you with a competitive edge and over the years we have mentored dozens of restaurant, cafe and bar owners through the various stages of their life cycle, from start-up right through to sale. We offer you a smorgasbord of accounting, tax, marketing and business coaching services designed to support and grow your business.

STARTING A RESTAURANT OR CAFE BUSINESS

If you are looking to open a restaurant, coffee shop, café or bar there are numerous issues to consider. As business start-up

specialists we can help you with every aspect including your site selection, business structure, tax registrations, insurances, your retail

lease and selection of accounting software. In addition, we can also assist you with preparing a business plan, set up your payroll and HR

requirements plus arrange finance for your shop fit out, car, van or catering equipment. On an operational level, we understand what is

required for a successful opening and we can assist you in executing the launch of your restaurant, bar, café, bistro, theatre

restaurant or coffee shop.

Menu pricing is absolutely vital to the success of your café, restaurant, bar or coffee shop and we can help you do some price

modelling so you know your break even point and how to maintain your profit margins when suppliers increase their prices. Using industry

benchmarks we can also help you compare the performance of your hospitality business against your peers so you know what is working in your

business and what areas still need working on.

Menu pricing is absolutely vital to the success of your café, restaurant, bar or coffee shop and we can help you do some price

modelling so you know your break even point and how to maintain your profit margins when suppliers increase their prices. Using industry

benchmarks we can also help you compare the performance of your hospitality business against your peers so you know what is working in your

business and what areas still need working on.

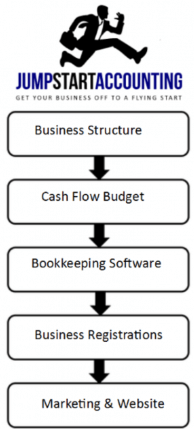

Starting a business is a bit like building a house and you need solid foundations that include the right tax structure, accounting software, insurances and marketing. Your choice of business structure is critical and there are a number of different options including sole trader, partnership, company and trust. When it comes to selecting the most appropriate tax structure for your business we always recommend you ‘start with the end in mind' because Australian tax laws are complex and changing your business structure at some point in the future can trigger a capital gains tax event that could prove costly. Whenever we provide advice on business structures we always take into account issues like:

-

Minimisation of Income Tax

- Maximize Asset Protection

- Allow for the admission of New Business Partners or Investors

- Comply with all Legal Requirements in your Industry

- Risk Profile of Your Industry

- Consider Future entitlement to Discount Capital Gains Tax Concessions

As a consequence, we often find your business structure is a compromise based on the relative importance of each of these issues.

Another brick in your business foundations is your choice of accounting software. Up to date, accurate financial records let you to make informed business decisions and the wrong choice of software can be catastrophic. Poor record keeping is one of the biggest causes of business failure in this country and when deciding on the most appropriate software program to use in your new business you need to match your business needs with your level of accounting skill. Too often business owners produce ‘computerised shoebox’ records that cause frustration, waste time and create additional fees. This conflicts with our mission of helping you slash the time and cost associated with bookkeeping and compliance.

You’ll find we support a range of different software options but we do have a preference for cloud based solutions like Xero,

QuickBooks and MYOB because of their flexibility and the fact that you can access your financial data via the internet and invite your

accountant or bookkeeper to view your financials at the same time. This means you can get bookkeeping support and valuable advice in

real-time. Log in anytime, anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is

automatically backed up and users have access to the latest version of your data plus you never need to worry about installing software or

program updates.

You’ll find we support a range of different software options but we do have a preference for cloud based solutions like Xero,

QuickBooks and MYOB because of their flexibility and the fact that you can access your financial data via the internet and invite your

accountant or bookkeeper to view your financials at the same time. This means you can get bookkeeping support and valuable advice in

real-time. Log in anytime, anywhere on your Mac, PC, tablet or smart phone to get a real-time view of your cash flow. Your data is

automatically backed up and users have access to the latest version of your data plus you never need to worry about installing software or

program updates.

To build a house you also need the right tools and when 'constructing' your business we have developed a number of tools including a start-up

expense checklist broken

down into various categories including:

To build a house you also need the right tools and when 'constructing' your business we have developed a number of tools including a start-up

expense checklist broken

down into various categories including:

- tools plus plant and equipment

- professional advice and software

- information technology costs – software and hardware

- marketing and signage

- furniture & fitings

This checklist will help you identify all your potential establishment costs and these figures then filter through to our cash flow budget template and allow us to produce a projected profit and loss statement for your first year of trading. These reports can also tuck neatly into our business plan template that is designed to help you secure funding from external sources like a bank. Another useful tool is our business start up checklist that walks you through key business registrations you might require like insurance options, legal issues, branding items and domain name registrations for your website.

If you're in hospitality, finance is always important and through our affiliate partners we can assist you with vehicle finance (chattel

mortgage, CHP or lease) and get you fleet pricing on your new car, ute or light commercial van that could save you thousands of dollars.

Through another affiliate partner we can also help you source funds to finance your business purchase, equipment or franchise fee (if

applicable).

If you're in hospitality, finance is always important and through our affiliate partners we can assist you with vehicle finance (chattel

mortgage, CHP or lease) and get you fleet pricing on your new car, ute or light commercial van that could save you thousands of dollars.

Through another affiliate partner we can also help you source funds to finance your business purchase, equipment or franchise fee (if

applicable).

If you're contemplating starting a business you don't need to reinvent the wheel as we have all the tools and resources to help you get off to a flying start. We can do some financial modelling based on different price points to produce profit forecasts and when you're up and running we can use industry benchmarks to compare your business performance against your peers.

MARKETING YOUR CAFE, RESTAURANT or FAST FOOD OUTLET

One of our biggest points of difference compared to traditional accounting firms is our marketing expertise. We can assist you with your branding (business name, logo and slogan) and where required, we can also help you create a corporate brochure and harness the power of social media to win more business.

Unfortunately a lot of restaurant websites are nothing more than electronic billboards that simply list the who, what and where of the business. On the other hand, over the past few years we have worked with dozens of clients to help them create affordable, lead generation websites with incredible functionality including booking systems, email marketing and landing pages. If you need direction or guidance with any part of your website including your design or content including videos, contact us today.

We'll introduce you to strategies like re-marketing, social media advertising and search engine optimization that can drive more visitors to

your website. We'll ensure your website is responsive to mobile devices (click here

to check your current website) and we strive to help you develop a serious competitive edge in your industry. The fact is, if you

aren’t using some of these marketing tools and techniques then your hospitality business probably won't reach its full profit

potential.

We'll introduce you to strategies like re-marketing, social media advertising and search engine optimization that can drive more visitors to

your website. We'll ensure your website is responsive to mobile devices (click here

to check your current website) and we strive to help you develop a serious competitive edge in your industry. The fact is, if you

aren’t using some of these marketing tools and techniques then your hospitality business probably won't reach its full profit

potential.

We are different to most accounting firms because we view the tax return as the start of the client process, not the end. Our mission is to help you fast track your business success and we offer our restaurant and hospitality clients a range of tailored financial, tax and accounting solutions including:

- Start-Up Business Advice for Restaurants, Cafes, Bars and Bistros

- Advice regarding the Purchase or Sale of your Restaurant, Café or Bar

- Spreadsheets like the Start Up Expense Checklist & Price Calculator

- Advice and Establishment of Your Business Structure

- Business Registrations including ABN, TFN, GST, WorkCover etc.

- Business Plans, Cash Flow Forecasts & Profit Projections

- Accounting/Point Of Sale Software Selection and Training

- Site Location and Advice Regarding your Retail Tenancy Lease

-

Preparation of Finance Applications & Bank Submissions

- Preparation and Analysis of Financial Statements

- Bookkeeping and Payroll Services

- Costing of Menu and Bar Items

- Tax Planning Strategies

- Industry Benchmarking and KPI Management

- Marketing Audit including an evaluation of your branding, website, brochure and menu layout plus diner trends and customer satisfaction questionnaires

- Advice regarding Website Development, Content and SEO

- Personal Financial Planning & Wealth Creation Strategies

- Business & Risk Insurances

- Vehicle, Equipment and Shop Fit Out Finance

- Monitoring and Controlling Labour costs

- Recession and Survival Strategies

- Business Succession Planning

Here at JTU Accounting Group we are more than just tax Accountants who keep the financial score for our hospitality clients. Our stable

of clients include a range of restaurants (Italian, Chinese, Japanese and fine dining) together with cafes, bars, bistros and take away food

outlets. Hospitality businesses have become a real niche within our accounting firm and if you’re looking to get your business off to

a flying start or want to get your existing business 'cooking, contact us today.

Here at JTU Accounting Group we are more than just tax Accountants who keep the financial score for our hospitality clients. Our stable

of clients include a range of restaurants (Italian, Chinese, Japanese and fine dining) together with cafes, bars, bistros and take away food

outlets. Hospitality businesses have become a real niche within our accounting firm and if you’re looking to get your business off to

a flying start or want to get your existing business 'cooking, contact us today.

We invite you to book a FREE, one hour introductory consultation to discuss your business needs and you can expect to receive practical business, tax, marketing and financial advice that could have a profound effect on your future business profits. To book a time, call us today on (03) 9878 5444 or complete your details in the box at the top of this page.

.jpg)