Superannuation Tax Planning Opportunities

Concessional Contribution Cap Of $25,000 For Everyone

The tax-deductible superannuation contribution limit or cap is $25,000 for all individuals regardless of their age. From 1 July 2018, members can make 'carry-forward' concessional super contributions if they have a total superannuation balance of less than $500,000. Members can access their unused concessional contributions caps on a rolling basis for five years. Amounts carried forward that have not been used after five years will expire. The 2019/20 financial year is the first year in which you can access unused concessional contribution.

The advantage of making the maximum tax-deductible superannuation contribution before June 30, 2020 is that superannuation contributions are taxed at between 15% and 30%, compared to personal tax rates of between 32.5% and 45% (plus 2% Medicare Levy) for an individual taxpayer earning over $37,000 per annum.

Typically, self-employed individuals and those who earn their income primarily from passive sources like investments make their super

contributions close to the end of the financial year to claim a tax deduction. However, individuals who are employees may also use this

strategy and those who might want to take advantage of this opportunity would typically include individuals:

- who work for an employer that doesn't permit salary sacrifice,

- who work for an employer that does enable salary sacrifice (but it’s disadvantageous due to a reduction in entitlements), and

- who are salary sacrificing, but want to make a top-up contribution to utilise their full concessional contributions cap.

Additional Tax On Super Contributions By High Income Earners

Additional Tax On Super Contributions By High Income Earners

The income threshold at which the additional 15% (Division 293) tax is payable on superannuation contributions is $250,000 per annum effective 1 July, 2017. Where you are required to pay this additional tax, making super contributions within the cap is still a tax effective strategy. With super contributions taxed at a maximum of 30% and investment earnings in super taxed at a maximum of 15%, both these tax rates are more favourable when compared to the highest marginal tax rate of 45% (plus 2% Medicare Levy) for individuals.

Government Co-Contribution To Your Superannuation

The Government co-contribution is designed to boost the superannuation savings of low and middle-income earners who earn at least 10% of their income from employment or running a business. If your income is within the thresholds listed in the table below and make a ‘non-concessional contribution’ to your superannuation, you may be eligible for a Government co-contribution of up to $500.

To be eligible you must be under 71 years of age at June 30, 2020. In 2019/20, the maximum co-contribution is available if you contribute $1,000 and earn $38,564 or less. A lower amount may be received if you contribute less than $1,000 and/or earn between $38,564 and $53,564.

| Tax Year |

Maximum Entitlement |

Low Income Threshold |

High Income Threshold |

| 2020/21 | $500 | $38,937 | $54,837 |

| 2019/20 |

$500 |

$38,564 |

$53,564 |

| 2018/19 |

$500 |

$37,697 |

$52,697 |

The matching rate is 50% of your contribution and additional eligibility requirements were added from 1 July 2017 which include:

- having a total superannuation balance of less than $1.6 million on 30 June of the year before the year the contributions are being made

- having not exceeded your non-concessional contributions cap in the relevant financial year.

Salary Sacrifice To Superannuation

If your marginal tax rate is 19% or more, salary sacrificing can be an effective way to boost your superannuation and also reduce your tax. By putting pre-tax salary into superannuation instead of having it taxed at your marginal tax rate you may save tax. This can be particularly beneficial for employees approaching retirement age.

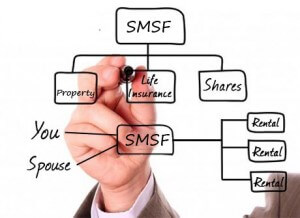

Self Managed Superannuation

A Self-Managed Superannuation Fund (SMSF) can provide significant tax savings but they are not for everyone. There are significant regulations surrounding the management and administration of SMSF’s. With the end of the financial year approaching, now is a good time to discuss the pros and cons of establishing your own SMSF. It might be appropriate to establish a SMSF in conjunction with other tax planning opportunities and we urge you to consult with us today. .

Other 2020 Year End Tax Planning Opportunities

- Back to the overview of the 2020 Year End Tax Planning Guide

- Round Up of Other Year End Tax Issues

- Instant Asset Write Off Strategies

- Other Tax Effective Strategies

- Key Tax Minimisation Strategies

- Download the full PDF

Disclaimer: This newsletter contains general information only and no responsibility can be accepted for errors, omissions or possible misleading statements. It is not designed to be a substitute for professional advice and does not take into account your individual circumstances. Therefore, no responsibility can be accepted for any action taken as a result of any information contained in this newsletter.

.jpg)